The Main Principles Of Basics of Medicare - Parts A, B, C, & D - NC DOI

Should I stay with Original Medicare or Choose a Medicare Advantage Plan?

The Only Guide to Original Medicare - HealthCare.gov Glossary

Medicare Advantage plans have a yearly limit on just how much members will pay in out-of-pocket expenses. If you select Medicare Benefit, it is very important to compare overall expenses including premiums, expense sharing, and out-of-network charges both amongst strategies and versus Initial Medicare. Cost sharing and benefits of the strategy you pick can alter from year to year so you require to assess protection throughout every Medicare open registration duration.

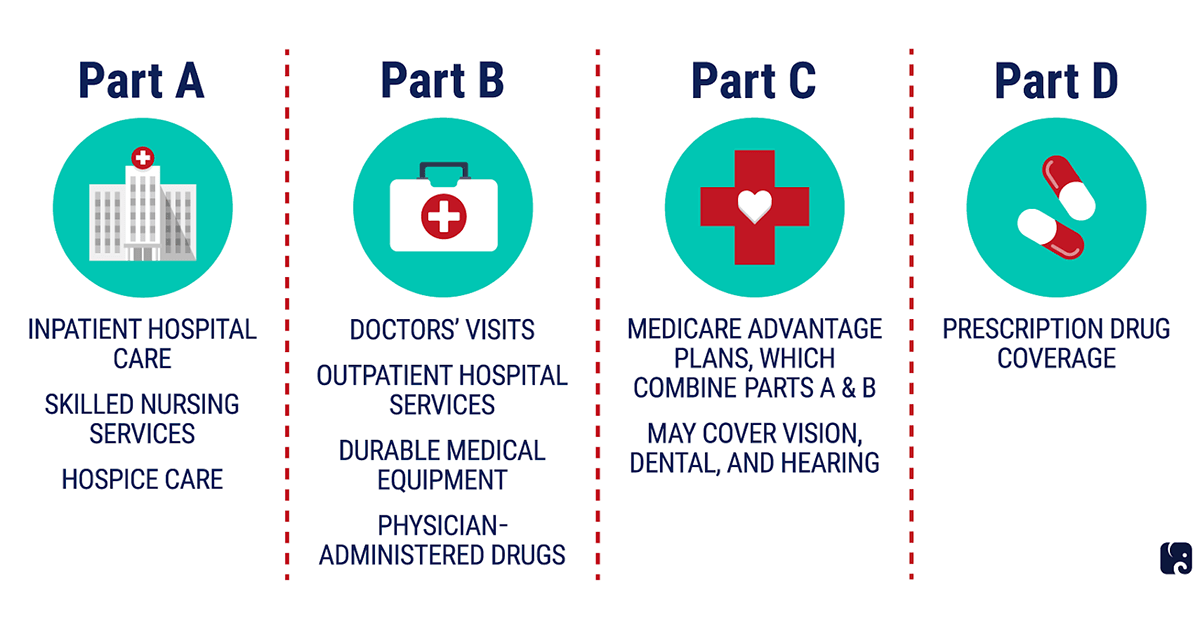

Medicare Part D Prescription Drug Coverage What Does Part D Cover? Presented in 2006, Part D, an optional program that covers prescription drugs, is the most current addition to Medicare. More Details . Premiums and cost sharing vary by strategy. You can get Medicare Part D coverage in one of 2 methods.

Original Medicare vsMedicare Advantage - American Senior Citizens Association

This is also real for the most part if you have a Medicare Advantage strategy that does not consist of prescription drug protection. Or, you can register in among the bulk of Medicare Benefit prepares that do consist of Part D protection. All Part D policies include a list of prescription drugs covered by the plan, called a formulary.

Formularies alter from year to year and even within the year so it is very important to check frequently that the medications you need are included in your Part D coverage. The Medicare Plan Finder on Medicare. gov can help discover a Part D strategy that covers your prescriptions. What Will You Spend For Part D? Premiums The 2022 base recipient premium is $33.

Who is eligible for Medicare? - HHS.gov Can Be Fun For Everyone

But premiums for Part D prepares vary by insurance company. Similar To Medicare Part B, high earners will pay an income-related month-to-month adjustment amount (Part D IRMAA), additional to premiums, ranging from $12. 40 to $77. 90, depending upon earnings level and state of residence. 11 You might also pay a late registration charge if you postpone joining when you're very first eligible and you do not already have prescription drug protection.

Some strategies have no deductible while the maximum amount permitted is $480 in 2022. Part D and Medicare Benefit plans with prescription drug coverage generally charge a copayment or coinsurance for each of the medications you purchase. Part D protection uses a tiered cost-sharing structure. This implies you will pay differing prices for various categories of drugs.